SEMBCORP INDUSTRIES-FAIR VALUE ESTIMATION

Page 1 of 1

SEMBCORP INDUSTRIES-FAIR VALUE ESTIMATION

SEMBCORP INDUSTRIES-FAIR VALUE ESTIMATION

Sembcorp Industries Ltd deliver its first quarterly result in 2017, sales revenue increased about 13% to SGD2.14 billion as compared to the same corresponding period of 2016. Operating profit before interest, tax, depreciation and amortisation increased marginally by 4.1% to SGD304 million on a year on year basis. However operating profit margin continue to decrease to 14.2% as compared to 16.8% in 2016, hence it signal that the company operation continue to remain in distress.

The breakdown of its group profit from operation show that apart from its marine business that further decreased 29% in current quarter, the rest of its business had managed to contribute positive growth to the group. Although marine business till date show no sign of recovery, I believe given time as the oil market continue to rebalance to further boost profitability to oil companies, demand for oil rigs and other marine business will eventually rebound. Once sentiment turn around, market will realised it had under priced the company and given time its fair value will be reflected in its stock price, a process which will happen similar to what DBS had gone through. Again, investors are encourage to maintain your confident in the company, continue to persist by holding on to your position and eventually we would be rewarded for doing so.

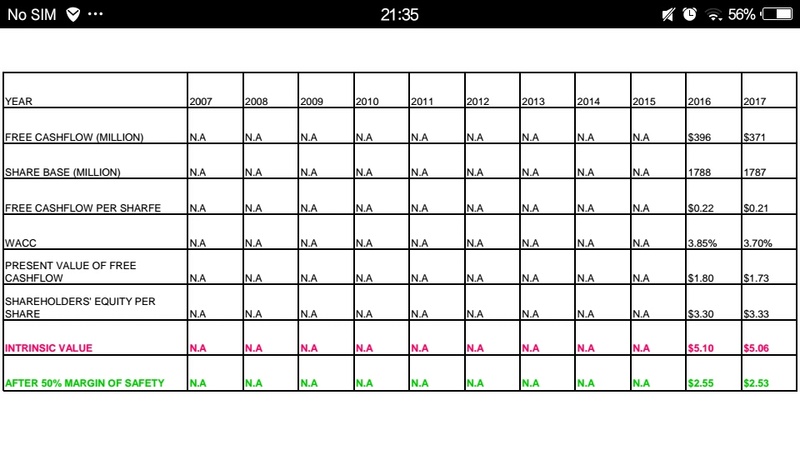

Below show my calculation on intrinsic value with the assumption of recovery in due course. This fair value does not represent the current fair value because its actual free cashflow currently is negative, which mean to say its current fair value is only equivalent to its shareholder equity. Nevertheless as mentioned above that I believed Sembcorp is fundamentally sound with a stable and consistent operating history, given time its earnings and cashflow will recover.

In addition, i also provide a fair value of SGD4.77 via PE model, an alternative estimation via different method. For simplicity, I will only use cashflow valuation for all future Sembcorp estimation, if anyone wish to know about PE value, just send me a message. Thank you.

The breakdown of its group profit from operation show that apart from its marine business that further decreased 29% in current quarter, the rest of its business had managed to contribute positive growth to the group. Although marine business till date show no sign of recovery, I believe given time as the oil market continue to rebalance to further boost profitability to oil companies, demand for oil rigs and other marine business will eventually rebound. Once sentiment turn around, market will realised it had under priced the company and given time its fair value will be reflected in its stock price, a process which will happen similar to what DBS had gone through. Again, investors are encourage to maintain your confident in the company, continue to persist by holding on to your position and eventually we would be rewarded for doing so.

Below show my calculation on intrinsic value with the assumption of recovery in due course. This fair value does not represent the current fair value because its actual free cashflow currently is negative, which mean to say its current fair value is only equivalent to its shareholder equity. Nevertheless as mentioned above that I believed Sembcorp is fundamentally sound with a stable and consistent operating history, given time its earnings and cashflow will recover.

In addition, i also provide a fair value of SGD4.77 via PE model, an alternative estimation via different method. For simplicity, I will only use cashflow valuation for all future Sembcorp estimation, if anyone wish to know about PE value, just send me a message. Thank you.

Similar topics

Similar topics» SEMBCORP INDUSTRIES-FAIR VALUE ESTIMATION

» SEMBCORP MARINE-FAIR VALUE ESTIMATION

» M1-FAIR VALUE ESTIMATION

» DBS-FAIR VALUE ESTIMATION

» QAF LTD-FAIR VALUE ESTIMATION

» SEMBCORP MARINE-FAIR VALUE ESTIMATION

» M1-FAIR VALUE ESTIMATION

» DBS-FAIR VALUE ESTIMATION

» QAF LTD-FAIR VALUE ESTIMATION

Page 1 of 1

Permissions in this forum:

You cannot reply to topics in this forum